Palantir: “Flesh wound” – Insider sells shares for $38 million

The price gap has almost been closed: Palantir shares fell to $85.25 in US trading yesterday. At the beginning of February, Palantir's share price jumped from $83.74 to more than $100 after the figures were released. Even then, the share was fundamentally valued very ambitiously. Today, the situation at Palantir appears to be calming down for the time being.

The stock initially stabilized at around 90 dollars in US trading.

According to documents from the US Securities and Exchange Commission (SEC), Shyam Sankar, the Chief Technology Officer and Executive Vice President of Palantir, sold a total of 375,000 shares of Palantir on February 20. Proceeds: $38.4 million. Sankar still holds 702,786 shares directly and 749,899 shares indirectly.

This news is not really surprising. Palantir insiders have sold several times in recent years (see further articles at the end of the article).

Palantir is one of the stocks that has performed particularly well in recent months. The potential for a setback is correspondingly greater.

According to Farzin Azarm, Managing Director at Mizuho Securities USA, retail investors are increasingly relying on leveraged products and could be forced to sell when prices fall. Tom Lee of Fundstrat, meanwhile, spoke of a "flesh wound" in view of the wave of selling in momentum stocks, which should not be a cause for concern for investors.

Technical factors are currently having a stabilizing effect on Palantir. The 38.2 percent Fibonacci retracement is around $86 and the 50-day line is around $85.

The wave of sales at Palantir is nothing unusual so far and should have been factored in by long-term investors. DER AKTIONÄR has already pointed out the potential for a setback several times in recent weeks. Ideally, Palantir could now turn upwards again. However, it is more likely that a certain consolidation phase is imminent at the current level. Even at the current level, Palantir is not a bargain from a fundamental perspective.

Note on conflicts of interest The board member and majority owner of the publisher Börsenmedien AG, Mr. Bernd Förtsch, has directly and indirectly taken positions in the following financial instruments mentioned in the publication or derivatives related to them, which can benefit from any price development resulting from the publication: Palantir Technologies.

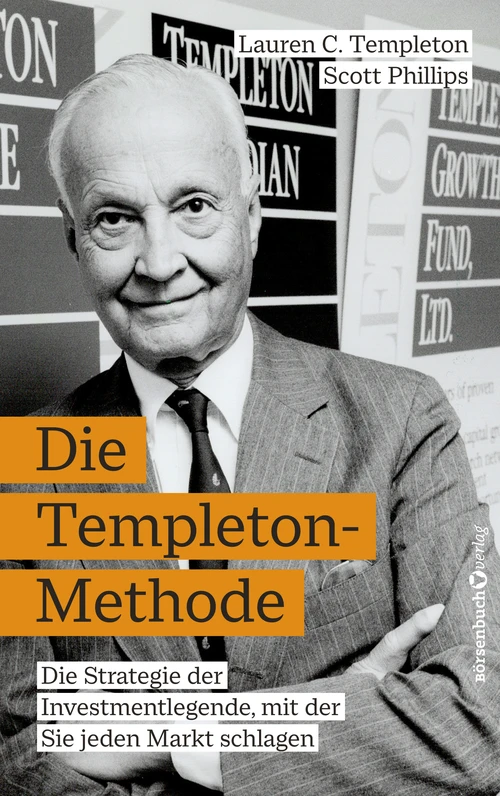

The legendary fund manager Sir John Templeton is considered one of the pioneers in the field of value investing and has consistently outperformed the market over a period of five decades. After reading this book, the reader will see Sir John Templeton's timeless principles and methods from a completely new perspective. Step by step, he will be familiarized with the stock market professional's tried and tested investment strategies. He will learn which methods Templeton used to select his investments and, with numerous examples from the past, will gain insight into Sir John's approach and his most successful trades. In these volatile times, investors can now more than ever turn Templeton's ideas into their own strategies and thus operate profitably on the financial markets.

deraktionaer.de